At a glance

- On 23 October 2023, the AASB released its Exposure Draft ED SR1 Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information to propose climate-related financial disclosure requirements.

- The Exposure Draft includes two draft Australian Sustainability Reporting Standards relating to financial disclosure.

- The proposed standards have been developed for the Australian market based on the recently released international standards, IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures.

- The Exposure Draft is available for comment until 1 March 2024.

- The proposed standards provide welcome clarity and detail around what is expected of disclosing entities in Australia. With that detail now available, disclosing entities and their insurers will need to start thinking about some key issues before the standards are introduced.

Introduction

The Australian Accounting Standards Board (AASB) has released two draft sustainability reporting standards1, heralding the next stage in the introduction of mandatory climate reporting in Australia. The draft standards are:

- ASRS 1 – General Requirements for Disclosure of Climate-related Financial Information, and

- ASRS 2 – Climate-related Financial Disclosures.

Consistent with recent Treasury consultation, but subject to legislation being passed, the standards are slated to be introduced from the 2024 financial year in the following cohorts (see table below):

| Group | Commencement | Who? |

| Group 1 | Annual period beginning on 1 July 2024 | Entities required to report under Chapter 2M of the Corporations Act 2001 (Cth) (Corporations Act) that meet two of the following thresholds:

AND Entities required to report under Chapter 2M of the Corporations Act that are a ‘controlling corporation’ under the National Greenhouse and Energy Reporting Act 2007 (Cth) (NGER Act) and meet the NGER publication threshold. |

| Group 2 | Annual period beginning on 1 July 2025 | Entities required to report under Chapter 2M of the Corporations Act that meet two of the following thresholds:

AND Entities required to report under Chapter 2M of the Corporations Act that are a ‘controlling corporation’ under the NGER Act and meet the NGER publication threshold. |

| Group 3 | Annual period beginning on 1 July 2026 | Entities required to report under Chapter 2M of the Corporations Act that meet two of the following thresholds:

AND Entities required to report under Chapter 2M of the Corporations Act that are a ‘controlling corporation’ under the NGER Act. |

The legal effect of accounting and audit standards

Section 296 of the Corporations Act 2001 (Cth) (Corporations Act) requires that financial reports must comply with accounting standards. These standards are set by the AASB, which is empowered under the Australian Securities and Investment Commission Act 2001 (Cth) (ASIC Act) to issue accounting standards. Similarly, section 307A of the Corporations Act requires audits to be conducted in line with audit standards. Under the ASIC Act, the Auditing and Assurance Standards Board (AUASB) has the power to make audit and assurance standards. In short, the standards have the effect of law.

In late 2022, Treasury released draft amendments to the ASIC Act that, if implemented, will provide power to the AASB to issue ‘sustainability’ standards and power to the AUASB to issue auditing and assurance standards for sustainability.2 That legislation has yet to be introduced. However, during the second round of Treasury’s consultation into mandatory climate reporting, it emerged that the ‘what and how’ of climate reporting will be contained in the accounting standards and that legislation will be released where it is needed to give effect to the new requirements.

Treasury’s consultation noted that climate reporting requirements will be drafted as civil penalty provisions3 but with certain initial protections for some elements of mandatory climate reporting, such as Scope 3 reporting.

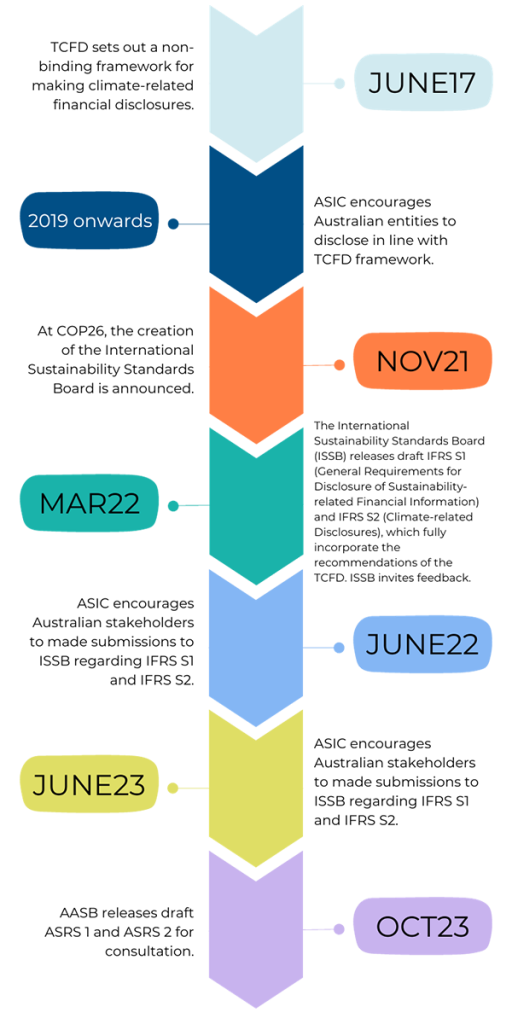

How the draft standards relate to the Task Force on Climate-related Financial Disclosures

The Task Force on Climate-related Financial Disclosures (TCFD) framework underpins the draft Australian standards.

The proposed standards and how they operate

The two proposed standards are to be read and applied concurrently.

ASRS 1 – General Requirements for Disclosure of Climate-related Financial Information

This standard contains the general terms and conditions of financial reporting. The draft standard covers the definitions, scope, timing and location of the disclosures. While the standard is detailed, the key provisions in ASRS 1 are the materiality requirements and the ‘core content’ of the disclosures.

Materiality and primary users

The materiality provisions of ASRS 1 require an entity to disclose material information about the climate-related risks and opportunities that could reasonably be expected to affect the entity’s prospects. The materiality of the information is judged by whether the inclusion or omission of the information would influence the decision of ‘primary users’ of the financial reports who have “reasonable knowledge of business and economic activities and who review and analyse information diligently”. As stated in the standard, “the decisions of primary users relate to providing resources to the entity” and involve decisions about:

- buying, selling or holding equity and debt instruments

- providing or selling loans and other forms of credit, or

- exercising rights to vote on, or otherwise influence, the entity’s management’s actions that affect the use of the entity’s economic resources4.

Core content

The core content of the proposed standard, which is based on the TCFD framework, is summarised in the following table.

| Area | Disclosures required |

|---|---|

| Governance |

|

| Strategy |

|

| Risk management |

|

| Metrics and targets |

|

ASRS 2 – Climate-related Financial Disclosures

This proposed standard operates concurrently with ASRS 1 and is limited to the disclosure of climate-related physical and transition risks and climate-related opportunities that the disclosing entity is exposed to. As with ASRS 1, this standard is grouped into its ‘core content’ categories. It draws on the content in ASRS 1 where applicable.

| Area | Disclosures required |

|---|---|

| Governance |

|

| Strategy |

|

| Risk management |

|

| Metrics and targets | Metrics

Targets

|

The requirements in ASRS 1 and 2 are supported by detailed explanations, appendices and reference materials. They provide welcome clarity and detail around what is expected of disclosing entities. The standards will also apply to not-for-profit entities but in slightly different terms.

Next steps for the standards

The standards are in draft mode and consultation is open until 1 March 2024. Based on the second round of Treasury’s climate report consultation draft, we expect draft legislation to give effect to the standards in the coming months.

The issues insurers and insureds should start thinking about

Many insureds and insurers are familiar with the TCFD and are already disclosing in line with that framework. These draft standards represent much needed clarity and detail on what the Australian requirements are likely to involve. With that detail now available, disclosing entities will need to start thinking about three key issues.

Initial limited protection for Scope 3 may be available

The standards contemplate the disclosure of Scope 1, 2 and 3 emissions, but allow for Scope 3 emissions not needing to be reported in the first annual period during which an entity discloses to the standard.

This moratorium is likely to have stemmed from the second round of climate-related financial disclosure consultation, which pointed to concerns raised during the first round of consultation about the lack of data available to inform accurate Scope 3 disclosures. Treasury agreed that this concern is “well-founded in the short-term…[t]here is a risk that without appropriate protections, entities would provide overly cautious disclosures that do not meet the needs and expectations of the market or investors.”5 Superannuation entities have raised specific concerns about the cost and effort to comply with Scope 3 reporting and the AASB has issued specific questions in the consultation directed at superannuation entities.

Climate risk is squarely an executive and board issue now

The importance of proper governance and remuneration will not be new to disclosing entities. The introduction of the Financial Accountability Regime means that banks, superannuation entities and insurers are already undertaking the necessary work to rewrite governance structures and remuneration schemes. The draft standards require there to be a governance body (a board or committee) or individual responsible for oversight of climate-related risks. Proposed requirements to disclose matters such as how the body or individual “takes into account climate-related risks and opportunities when overseeing the entity’s strategy, its decisions on major transactions and its risk management processes and related policies, including [the body or individual] has considered trade-offs associated with those risks and opportunities” also represent a clear expectation that the body or individual has a decision-making role (or at the very least has direct access to decision-makers).

Is the organisation climate literate and to what extent is external assurance required?

The ‘metrics and targets’ component of ASRS 2 is complex and requires specialist knowledge of areas such as internal carbon prices, greenhouse gas emissions, carbon offsets and various climate target objectives, such as mitigation, adaptation or conformance. Disclosing entities should consider whether they need to begin upskilling staff or recruiting staff, and whether they need to engage auditors or external advisors with expertise in these areas.

1 www.aasb.gov.au/admin/file/content105/c9/AASBED_SR1_10-23.pdf

2 The draft legislation also proposes to give the AUASB power to develop auditing and assurance standards for sustainability and the Financial Reporting Council power to have a strategic oversight of the AASB and AUASB’s sustainability standards functions.

3 Treasury – Climate-related financial disclosure: Second consultation, accessible at: https://treasury.gov.au/consultation/c2023-402245

4 Separate criteria apply to not-for-profit entities but include decisions, such as parliaments deciding whether to fund particular programs and donors deciding to donate resources to an entity.

5 https://treasury.gov.au/sites/default/files/2023-06/c2023-402245.pdf (pg 29)